The decline in the Japanese yen

03.07.2024

The decline in the Japanese yen exchange rate between the strength of the dollar and the intervention of the Central Bank of Japan

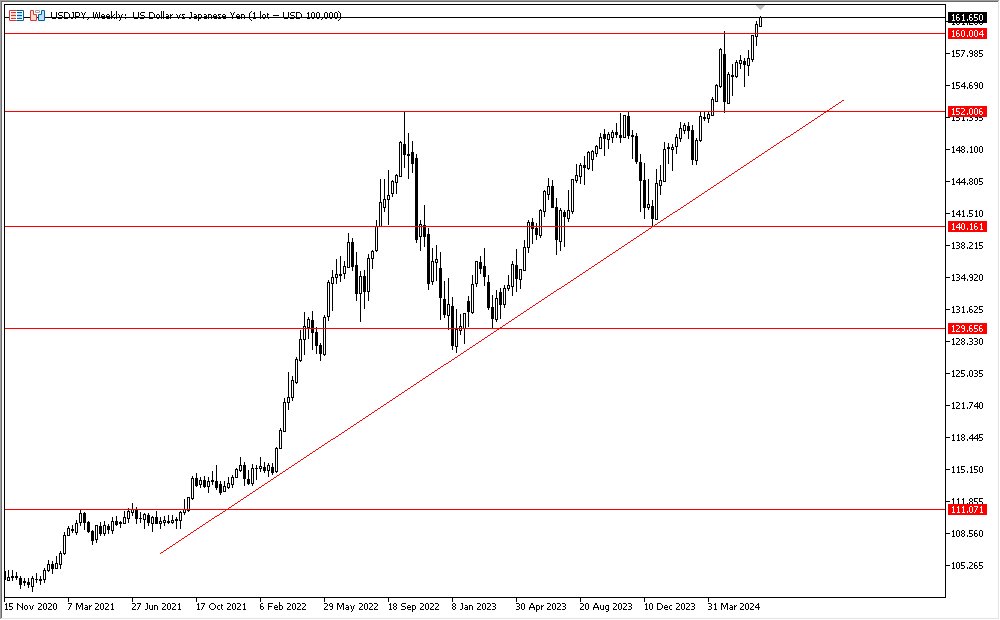

The strength of the US dollar continued to put pressure on the Japanese yen, as the US dollar rose and reached historic levels that exceeded 160 yen, the highest in 38 years, as it broke through the level of 159.71, at which the Japanese authorities intervened to support the yen and sell the US dollar last April, which made markets alert and cautious. The Japanese yen reached the level of 160.88, its lowest level since 1986, and the loss comes after abandoning trading at the level of 160 yen per dollar, which is a red line for the Bank of Japan to intervene again in the currency exchange market.

The previous chart shows the rise of the dollar against the Japanese yen, as the Japanese currency fell by about 2% in June and more than 14% during the current year so far and is about to trade below the level of 162 yen per dollar for the first time since 1986 and if the large difference between interest rates between the United States and Japan continues, this will lead to the Japanese government being forced to intervene in the exchange market to keep the Japanese yen from falling further and in light of the silence of the Japanese central bank from The yen is expected to reach 163.00 yen to the dollar and then 165.00.

The previous chart shows the weakness of the yen against the basket of currencies, as it broke a strong support level on the weekly framework at 65.80 and increased the weakness of the yen on the back of data that showed a decline in GDP on a quarterly basis to reach -0.5% below the previous reading, which was at 0.1%, and therefore a further decline is expected for the yen index and may reach the level of 60.00, At the BoJ's June meeting, the Bank of Japan decided to keep its current 6 trillion yen purchases plan for Japanese government bonds and announced it would draw up plans to reduce purchases over the next two years at its next monetary policy meeting.

But after Japan's economic growth fell, the Bank of Japan is more likely to delay plans to scale back bond purchases and the prospect of further interest rate hikes this year has eased.